The Effect Of South Pars’ Production On Fossil Fuel Prices and The Effect Seismic Activity

- Strategeriest

- Jul 18, 2021

- 2 min read

Good afternoon,

At 10:34 AM EST this morning, an earthquake once again rocked Iran’s Fars Province. The Fars Providence is home to South Pars.

“The South Pars/North Dome field is a natural-gas condensate field located in the Persian Gulf. It is by far the world's largest natural gas field,[1] with ownership of the field shared between Iran and Qatar.[2][3] According to the International Energy Agency (IEA), the field holds an estimated 1,800 trillion cubic feet (51 trillion cubic metres) of in-situ natural gas and some 50 billion barrels (7.9 billion cubic metres) of natural gas condensates.[4] On the list of natural gas fields it has almost as much recoverable reserves as all the other fields combined. It has significant geostrategic influence.[5] “

Damage to the infrastructure in this region could have an impact on fossil fuel prices in the near-term, long-term depending on the severity of the damage and Iran’s economy.

“Iran’s GDP in 2019/20 is estimated at US$463 billion. With a population of 82.8 million people, Iran’s economy is characterized by the hydrocarbon, agriculture, and services sectors, as well as a noticeable state presence in manufacturing and financial services. Iran ranks second in the world in natural gas reserves and fourth in proven crude oil reserves.”

“The lifting of most nuclear-related sanctions under the Joint Comprehensive Plan of Action (JCPOA) in January 2016 sparked a restoration of Iran’s oil production and revenue that drove rapid GDP growth, but economic growth declined in 2017 as oil production plateaued. The economy continues to suffer from low levels of investment and declines in productivity since before the JCPOA, and from high levels of unemployment, especially among women and college-educated Iranian youth.”

This, however, has not decreased funding to Hezbollah or inhibited their nuclear ambitions, increasing geopolitical risk in the region which should be noted.

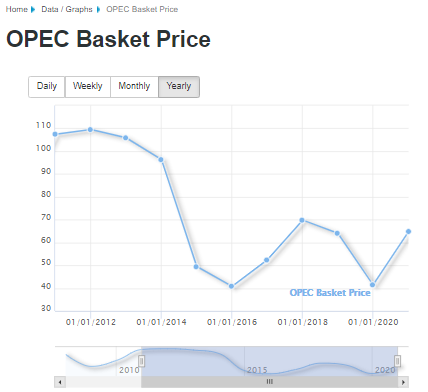

I am still searching for information on the severity of damage caused by the quake but expect a short-term decline in supply issues stemming from this natural disaster in both natural gas and oil. As OPEC recently negotiated increases in oil production limits among its members, I assume other members are already in the process of ramping up their production and it may take them less time to allocate the slack in this asset class than it will in natural gas.

Oil is still well below its 2014 highs but had been on an uptrend prior to this week as noted in previous articles. With most analyst expecting the Ten-Year to rise, because the fiat monetary system works great if governments do not spend more than they take in, because…credit risk = inflation.

Due to these competing factors, I am expecting volatility in these fossil fuel asset classes until trends normalize.

Warmest Regards,

Comments